Investment Advisory

-

How we help

ENGAGEMENT MODELS

INDEPENDENT SERVICES

- Who we are

- Client Speak

- Insights

- Careers

- Media

- Contact

- Get in Touch

- Get in Touch

Investment Advisory

China’s stock market has been on a tear.

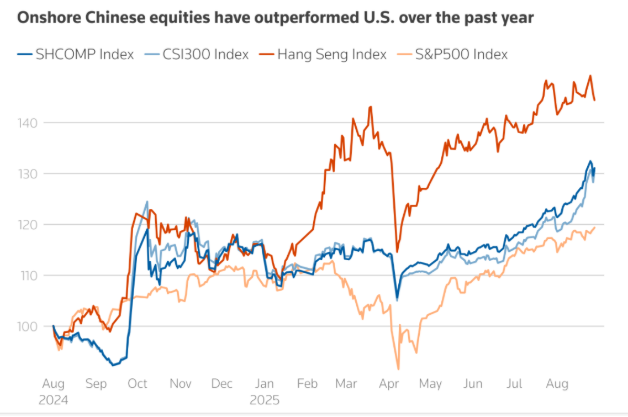

The Shanghai Stock Exchange Composite Index (SSE) has climbed ~40% straight since September 2024, recently touching its highest level in ten years.

Is this rally real — and how long can it actually continue?

Here’s the full picture in one clear narrative.

A.) Why Chinese Markets Have Been Rallying?

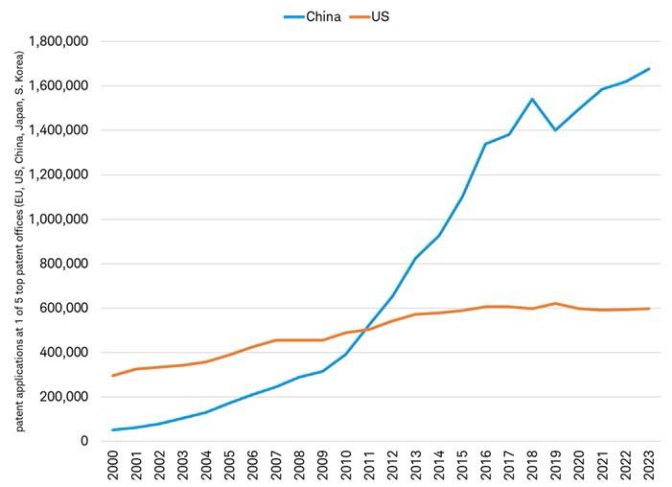

A big part of China’s market strength comes from its tech leadership.

China has clearly transitioned from being viewed as a low-cost imitator to becoming a genuine innovator, doubling down on “hard tech” — semiconductors, AI infrastructure, robotics, EVs, and industrial automation — & is now one of the world’s largest patent filers in AI and advanced manufacturing.

This push has created a strong pipeline of innovative companies, especially in chip design, EV supply chains, and automation equipment.

Global investors see this as China’s next long-term growth engine, prompting a rotation of funds into sectors tied to AI adoption, onshore tech self-reliance, and industrial upgrading.

These structural themes provide some depth to the rally, making it more than just a short-term sentiment bounce.

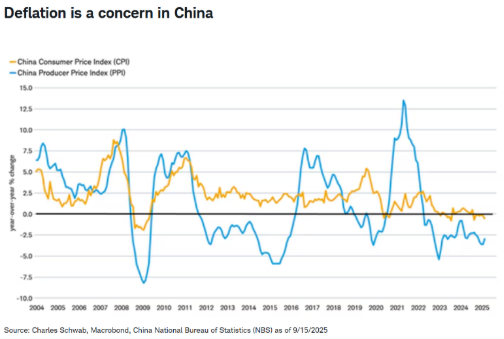

China has a structural problem of overcapacity, which is creating deflation. Beijing has rolled out policies aimed at reducing excessive competition (“anti-involution”), stabilizing prices, and improving corporate profitability. That alone has boosted market confidence.

Lower noise = higher risk appetite. Policy clarity and calmer geopolitics have encouraged more institutional buying.

Chinese stocks still trade at a significant discount to U.S. tech and other global peers. So investors see “catch-up potential,” especially as global funds rebalance toward undervalued regions.

B.) Why This Rally May Not Be Built to Last Forever

Despite the momentum, there are cracks under the surface:

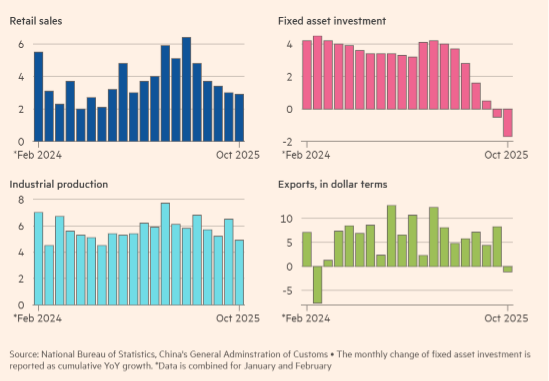

China’s real-estate sector has been under severe stress after years of overbuilding, slowing population growth, oversupply, and weakening demand that left many cities with far more homes than buyers.

Developers had expanded using heavy borrowing and pre-sales, and when Beijing tightened borrowing rules in 2020, though intention was good, timing was bad triggering liquidity crunches, defaults, and stalled projects at even major firms like Evergrande and Country Garden.

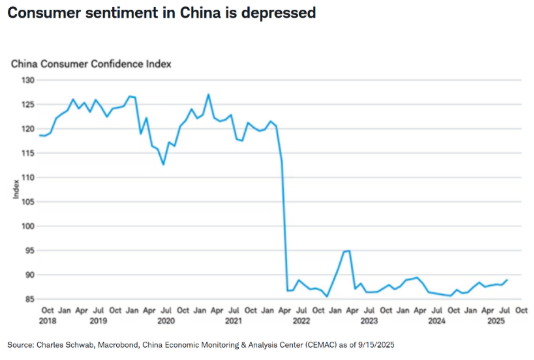

This collapse eroded homebuyer confidence, and since property is where most Chinese households store their wealth, falling prices hit family finances, consumer sentiment, and banks. Local governments, reliant on land sales, also came under strain.

With rising inventory, slowing construction, a loop of falling prices and weaker confidence, the property slump continues to drag on consumption, employment, credit growth, and economic stability—posing one of the biggest risks to the durability of China’s market rally.

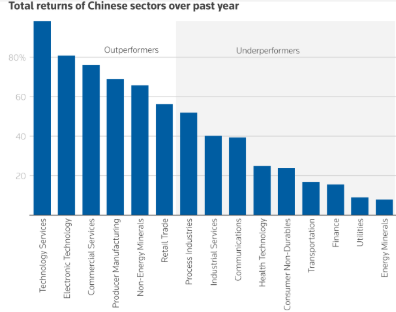

2.Rally Is Too Narrow: Only a handful of sectors (mostly tech + AI) are driving the surge.

Broader market breadth is still weak — a classic warning sign.

CPI is near zero (weak consumer pricing power) with consumer confidence being depressed.

In simple words:

Markets are flying but the economy is still walking.

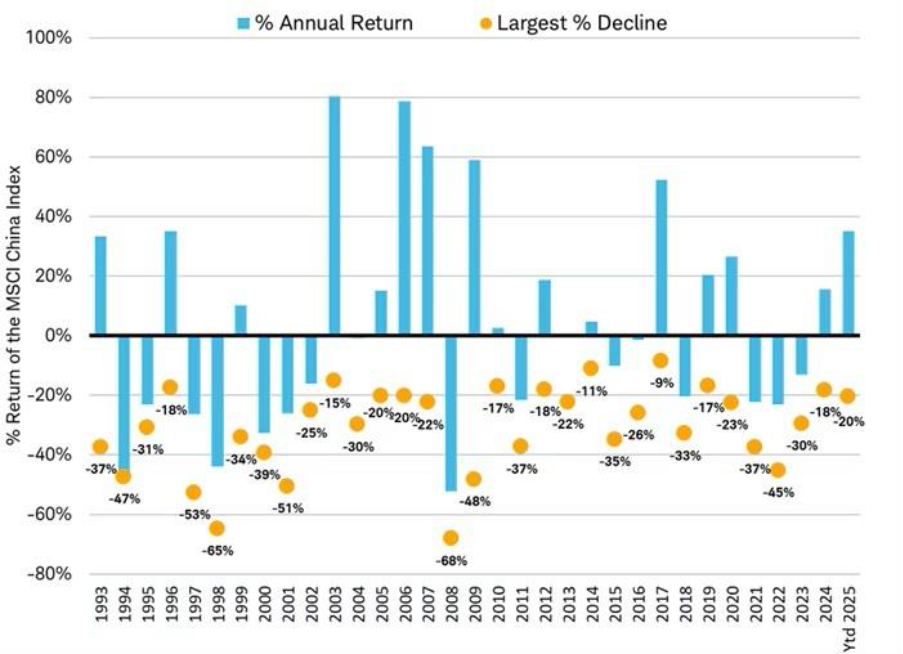

6. China’s Markets Have a History of Sharp Drops: China has seen a 20%+ correction almost every year. Volatility is part of the DNA of this market.

C.) So… How Long Can This Rally Continue?

Next 3–6 months: Momentum likely continues. AI themes are strong, policy tone is friendly, institutions are deploying money. Unless there’s a shock — geopolitics or a policy misstep — markets should stay supported.

6–12 months: This depends on earnings and domestic demand. If corporate profits stabilise and consumption picks up, the rally can extend. If not, expect volatility and sector rotations.

Beyond 12 months: This is where it becomes tricky. The rally cannot keep running simply on valuation re-rating.

It needs:

Without these, the rally will lose steam, and corrections could return.

Bottom line:

The rally can likely continue into late-2025 and maybe early-2026, but staying beyond that needs real economic improvement, not just good vibes and policy support.

Portfolio Strategy — What This Means for Investors

Scenario Breakdown

Bull Case (Policy + Earnings Improve): If domestic demand and earnings turn up, and policy stays supportive & rally can extend into 2026 with meaningful upside.

Base Case (Strong Themes, Weak Economy): Narrow rally continues → volatile but positive till end-2025.

Bear Case (Policy Mistake or Macro Dip): Weak consumption, property shock or regulatory tightening leading to sharp correction, given leverage levels.

The rally in Chinese markets can run through late-2025 and maybe spill into 2026 — but beyond that, it needs real economic and earnings recovery. Momentum alone cannot carry it.

In this edition of our Philanthropy section, we highlight two organizations that place children at the centre of social change. Enfold Proactive Health Trust and Apni Shala Foundation work in different but complementary ways to create safer, more resilient, and emotionally aware environments for young people. One focuses on protection, rights, and restorative justice, while […]

For Indian families, Golden Visas have quietly evolved from a migration product into a strategic financial planning decision. What began as a route to overseas residency is now closely linked to currency risk, global asset allocation, mobility planning, and long-term family optionality. Yet, many families still approach Golden Visas as a one-time transaction, often at […]

When an investor exits an Indian company by selling equity shares, the transaction attracts capital gains tax under the Income Tax Act, 1961. The law treats any right in relation to an Indian company as a capital asset. As a result, any surplus earned on the sale of equity shares is taxed as capital gains. […]

signup for updates