Family Office

-

How we help

ENGAGEMENT MODELS

INDEPENDENT SERVICES

- Who we are

- Client Speak

- Insights

- Careers

- Media

- Contact

- Get in Touch

- Get in Touch

Family Office

Entrepreneurs and CXOs are the architects of all round prosperity, including their own. From the initial grind of building a business to the monumental task of ensuring that their legacy spans generations, the journey is anything but linear. At Entrust, we are more than advisors; we are partners in the noble endeavour of building wise wealth.

What is wise wealth? It is wealth that is clean, patient, quiet, cautious, simple to manage, well-planned, a means to an end, and one that leaves behind a better world.

Entrust offers bespoke solutions to support this philosophy across every stage of your journey.

Starting a business comes with unrelenting challenges, many of which are rooted in financial complexities. Entrust steps in with corporate CFO services to:

Our goal is simple: Empower you to focus on growing your business, while we handle your financial backbone. Additionally, we ensure that your business is built on a solid financial foundation, enabling sustainable growth. For businesses that need flexible, cost-effective solutions, our outsourced CFO services provide the expertise of a full-time CFO without the overhead, allowing you to focus on scaling your operations.

There are other ways in which we partner with entrepreneurs to build lasting enterprises, by helping with ecosystem connections, fund raising, valuation and business advisory, among other things.

With your business thriving, managing personal wealth becomes critical. Entrust offers:

Our personal investment management services help you grow and protect your personal wealth alongside your business. We simplify the complex, allowing you to nurture your wealth without distractions. Over and beyond this comes pedigree. The team that is expert enough to serve the Multi-Family Office clients caters to the Personal Investment Management clients as well.

When wealth scales beyond ₹50 crores, managing multiple dimensions becomes crucial. Entrust’s Multi-Family Office services provide:

We serve as your lifestyle partner and a reliable custodian of your family’s legacy, managing every aspect of your portfolio with precision and care.

Other services that clients can make use of from this point onwards are Family CFO services that span all aspects of financial management – from seamless bill payment, accurate accounting, and strict compliance to advanced digitization of estate records and cutting-edge dashboard automation.

For those who have amassed significant wealth, Entrust offers a fully dedicated team through our Single Family Office services. Here’s what sets us apart:

Our model provides all the benefits of having a dedicated team without the stress of setting it up. We take care of hiring, grooming and retaining the right talent, aligned to your ideology. We ensure that your wealth is not only managed but also aligned with your vision for the future.

We have a strong focus on legacy because superlative success must be preserved across generations, and positively impact as many stakeholders as possible, for as long as possible. Entrust helps ensure your wealth lasts across generations through:

Specific services we offer as part of this vertical are: estate planning, creation of wills, formulation and management of private trusts, family management services and more.

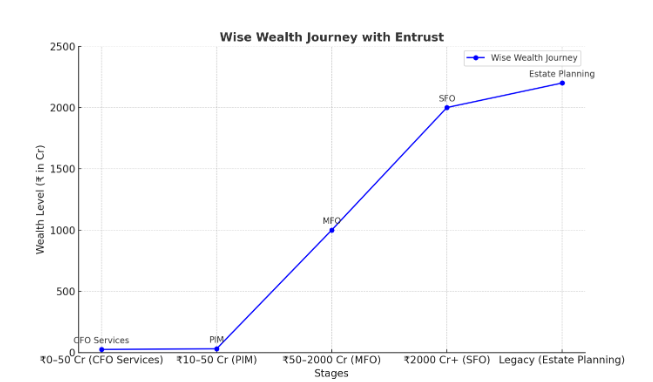

Below is a visual representation of how Entrust partners with you at every stage of your wealth-building journey:

At Entrust, we take pride in walking alongside first-generation entrepreneurs and CXOs. Your journey is unique, and so is our approach. As your wealth grows, our partnership evolves—offering the expertise, foresight, and dedication needed to build wealth that matters.

Are you ready to embark on your wise wealth journey? Let Entrust be your partner.

Connect with us today to learn more.

In this edition of our Philanthropy section, we highlight two organizations that place children at the centre of social change. Enfold Proactive Health Trust and Apni Shala Foundation work in different but complementary ways to create safer, more resilient, and emotionally aware environments for young people. One focuses on protection, rights, and restorative justice, while […]

For Indian families, Golden Visas have quietly evolved from a migration product into a strategic financial planning decision. What began as a route to overseas residency is now closely linked to currency risk, global asset allocation, mobility planning, and long-term family optionality. Yet, many families still approach Golden Visas as a one-time transaction, often at […]

When an investor exits an Indian company by selling equity shares, the transaction attracts capital gains tax under the Income Tax Act, 1961. The law treats any right in relation to an Indian company as a capital asset. As a result, any surplus earned on the sale of equity shares is taxed as capital gains. […]

signup for updates